Smallsats Drive the Push for Nimbler Propulsion Options

As the missions and business cases for smallsats evolve and grow, smallsat propulsion solutions are innovating to keep up. July 25th, 2022As the missions and business cases for smallsats evolve and grow, smallsat propulsion is innovating to keep up. Smallsats need more flexibility and maneuverability, and access to multiple orbits. How are changing mission requirements affecting propulsion requirements and what technologies are poised to disrupt the industry?

According to Mike Cassidy, founder of Apollo Fusion and now VP of product development for Astra, missions require more propulsion today than in the past for several reasons, including the increasingly charged geopolitical landscape.

“With the tragedy in Ukraine and other places, there's certainly some fear that you might need to have satellites that are more mobile so they are more survivable,” Cassidy says.

Scenarios by bad actors could include launching an anti-satellite system or targeting the satellite with a laser or cyber-attack, notes Riskaware, a U.K.-based incident modeling solutions provider.

Another reason is the fact that new spacecraft are mandated to de-orbit at the end of mission life to help minimize space junk. In addition, spacecraft are flying lower than ever because the closer they fly to the ground, the better image resolution and throughput speed they’ll have. However, low-flying performance gains come at a price.

“The advantages of flying lower are great but [it requires] more propulsion,” says Cassidy.

As the industry moves from cubesats to larger and heavier small satellites, operators will need more power and more propulsion to perform their mission, whether it’s for orbit raising, station keeping, collision avoidance, or de-orbiting a satellite at end of life.

“As small satellites become larger and more powerful, it drives the need for increased propulsion performance,” says Armen Askijian, chief technology officer of Airbus U.S. Space & Defense. Airbus is half of the joint venture overseeing manufacturing of OneWeb’s broadband constellation. “Upcoming and next generation LEO [Low-Earth Orbit] constellations are pushing towards more capable satellites to meet their mission needs.”

Historically, satellite operators have relied on chemical propulsion, which delivers high thrust in a short period of time. Prior to 1981, virtually all satellites that carried propulsion used chemical propellant, explains Andy Hoskins, in-space propulsion manager for Aerojet Rocketdyne, who previously served as chief technologist for Electric Propulsion, based at the company’s Redmond, Washington, facility.

But as smaller spacecraft operators eye cost-effective access to Low-Earth Orbit, another option is growing in popularity: electric propulsion (EP).

“Since 2019, a lot more satellites in LEO, especially very small satellites, have been using EP in increasing numbers,” says Hoskins, noting that all the large constellation providers such as Starlink and OneWeb have opted for electric.

However, electric isn’t exclusive to just large LEOs. According to Hoskins, GEO satellite operators over the last 20 years have leveraged both options, with about half of GEO satellites using at least some electric propulsion (often for station keeping) and half relying only on chemical propulsion. But the fuel-efficiency advantages of electric propulsion for station keeping are clear regardless of the orbit.

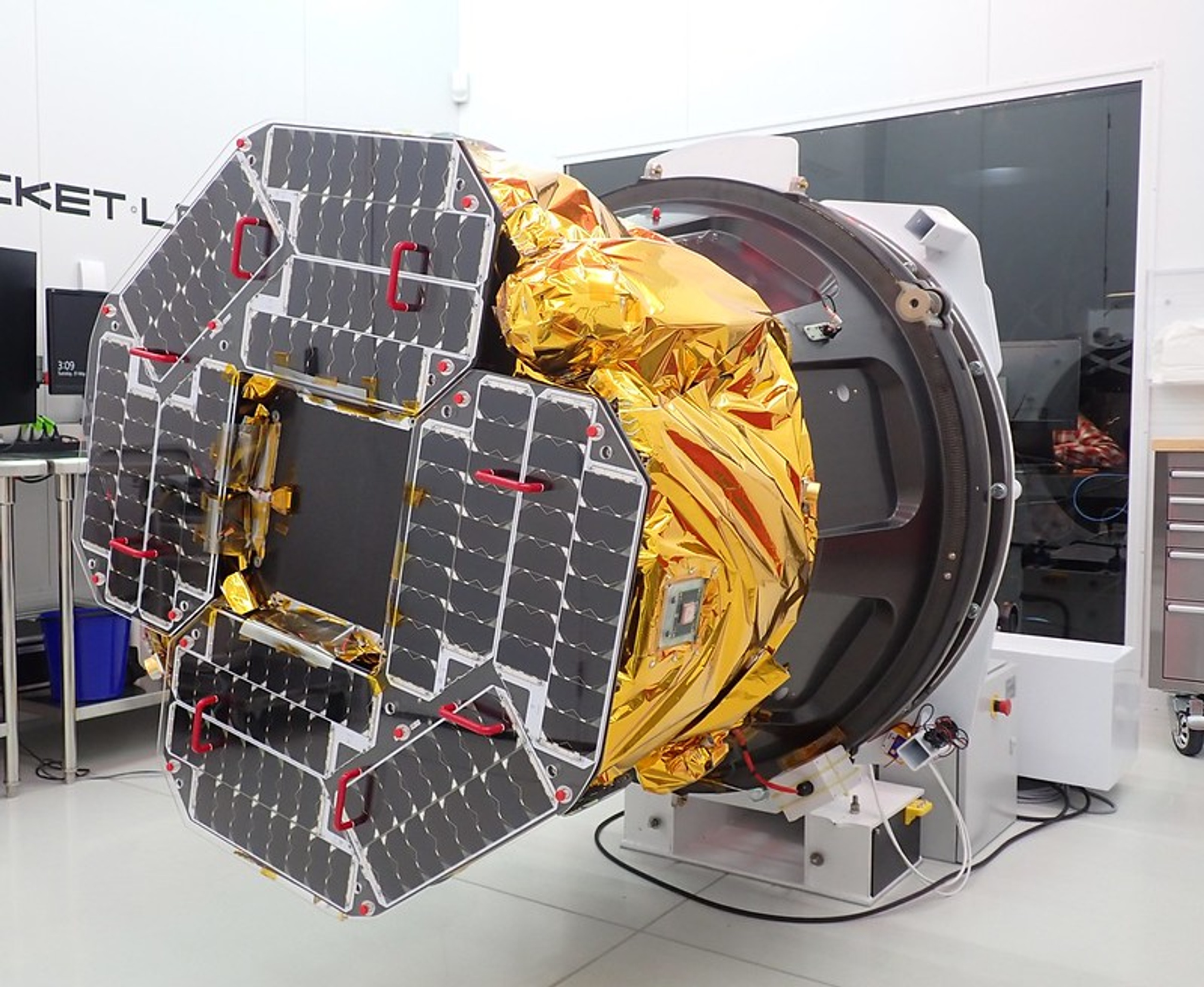

“Electric propulsion enables you to stay in orbit longer and do maneuvers. But if you want to break free of Earth’s gravity in a meaningful way, chemical propulsion is the way to do it,” observes Peter Beck, CEO of Rocket Lab, which has expanded its focus beyond launch into space systems, including powerful, lightweight chemical propulsion systems.

Chemical’s Power Play

Since 2017, RocketLab has deployed 147 satellites to orbit for customers across the U.S. government, including a recent pathfinding mission to lunar orbit for NASA’s Artemis program. The same model of spacecraft will be used in a Venus mission tentatively scheduled for 2023 to explore potential life on Mars.

The vertically integrated company developed an entirely new propulsion system that is “on-orbit storable and non-toxic, with crazy high performance,” says Beck, explaining that typical systems must pressurize propellant to force it into the rocket engine.

“We built these little electric pumps that pump it into the engine. In between the burns the sun recharges all the batteries for these pumps. We're harnessing the sun's energy to create the energy to then run the rocket engine,” he says.

According to Beck, flying to the Moon using electric propulsion is possible, but it would take months, whereas chemical propulsion “can get you on your way in a few days.”

For many space companies eyeing LEO opportunities, electrical propulsion, which uses electrical energy to accelerate propellant to create thrust, is the answer. Complexity and cost are both factors when deciding which propulsion approach is best.

“Electrical propulsion is more complex, so it's more expensive typically than a chemical propulsion system,” notes Hoskins.

If a satellite needs to do a lot of thrusting for a long period of time, or change its velocity a large amount, electric propulsion might be the better option since it holds a bigger tank of gas, Hoskins says.

Slower Maneuvering Electric Propulsion Dominates in LEO

“Propulsion is critical for LEO constellations because people are worried about responsible use of space and not creating space debris. Being able to deorbit your own satellites actively and reliably is a critical requirement coming from both the U.S. government customers and also commercial customers,” notes Askijian.

Electric propulsion is everywhere these days because it provides high efficiency with low mass. It also eliminates the hazardous materials used in chemical propulsion.

That’s proven true for OneWeb, which has launched 428 of its planned 648 LEO satellites to date using electric propulsion. Askijian says a significant challenge was rethinking propulsion to fit the LEO business model, which requires the spacecraft, including propulsion, to be built under much shorter lead times without sacrificing quality.

“Anytime you're constrained in mass and volume and you have to pack in a lot of complexity, the solution can be a challenge from a design perspective,” he explains.

Airbus engineers designed OneWeb’s electric propulsion module to be assembled and tested in-house at the company’s production facility on the Space Coast in Merritt Island, Florida. The company subcontracted the components in the propulsion module, but its in-house team handles all the mechanical and electrical testing and integration.

“The Florida operations include propellant loading, which eliminates the need to handle propellant at the launch base,” he says.

Astra, another electrical propulsion player, offers flexible configurations to handle a range of missions since acquiring Apollo Fusion last year. To date, the company has sold over 80 systems to customers such as Spaceflight, York Space Systems, and LeoStella. According to Cassidy, the days of taking six to nine months to design a propulsion system and another six months to build and test it are long gone. Rapid iteration is the key.

Keeping pace with the number of planned LEO launches, an estimated 20,000 satellites in the next 10 years, requires a new approach to aerospace design, Cassidy explains. He leverages his prior experience at Google, a company known for innovating fast, to help build Astra into “a new type of space company” that iterates rapidly.

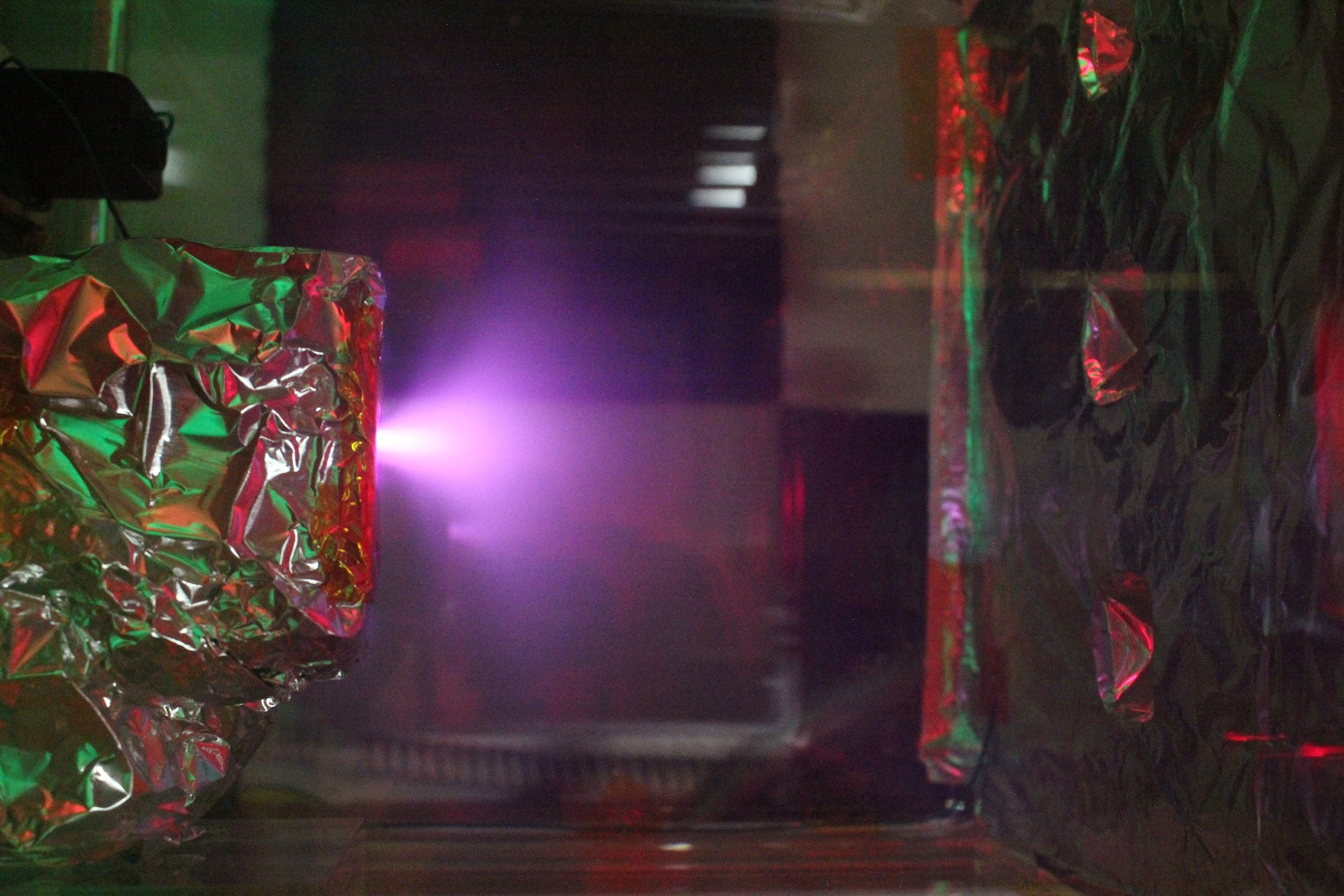

The team leverages ground-based vacuum chambers to test thruster performance for their Astra Spacecraft Engine. Astra combines this rapid iteration with “very high-end electronics simulation in addition to thermal, vibration and structural load simulations.” To deliver engines to customers, Cassidy says it was not uncommon for the team to “find something out on Monday, make a design change on Tuesday and have a new version of a thruster up by Wednesday.”

Increasing Propellant Demand

A big piece of the propulsion equation is the propellant. Hall thrusters rely most commonly on xenon and krypton. They use electric current and these gases to propel a craft through space. Askijian has seen xenon, used in OneWeb’s satellites, increase in price significantly, in part from the conflict in the Ukraine, which is a heavy supplier of the noble gas.

“There's no propellant out there that we're seeing a reduction in demand for. Everything's just increasing,” he says, adding that his firm is looking at alternative propulsion sources, including krypton.

The cost and shortage of traditional electric propulsion propellants has given rise to alternatives such as iodine and even water, though the industry has yet to choose a clear winner, notes Mitchell Walker, professor in the Daniel Guggenheim School of Aerospace Engineering at Georgia Institute of Technology and director of NASA’s Joint Advanced Propulsion Institute (JANUS).

“With smallsats, the correct propellant has not been identified,” says Mitchell, who notes that traditional diagnostics are not designed to work with molecular or condensable propellants, which has led the industry to use new diagnostics tools that “go after the physics of these devices so that we can understand how they will perform.”

Promising Alternatives: Iodine, Water, and Nuclear

ThrustMe, a deep tech company founded in 2017 by two Ecole Polytechnique and CNRS plasma physicists, began by building xenon systems before opting for iodine, which ThrustMe found to take up half the space with 50 percent less cost. ThrustMe launched the first all-iodine-propelled satellite into orbit in 2019 with partner Spacety.

That historic flight didn’t use plasma, but today the French firm has five iodine-based plasma systems in space and has developed 10 more systems for Earth observation, SAR, and LEO constellation operators. The company is betting big on iodine as the next enabling propellant for assuring space sustainability.

“Compared to classical propellants, the pressure of our storage is almost zero because iodine is solid,” says CTO Dmytro Rafalskyi, who explains that the propellant also comes prefilled to customers, which simplifies and streamlines the satellite integration process.

Rafalskyi credits his firm’s success to date with how much material science has moved forward compared with the past. These advances have enabled his team to validate their system through ground testing and modeling.

“We've got the tools for analysis of samples … and the ability to do powerful simulations when we need it,” he says, citing significant telemetry data on how the propellant has performed.

Water, another promising propellant for smallsats, is coming into its own thanks to companies like Miles Space.

“We feel that the market really wants water – I'd like to see a future in deep space with our power efficiency where water is a common byproduct,” says Miles Space CEO Wes Faler.

He says a key challenge is finding propulsion sources that are power efficient and use minimal fuel while supplying enough thrust to get a satellite to its final orbit.

His firm’s M1.4 Thruster with ConstantQ propulsion technology – developed over two years on a computer using basic electronics modeling and a simulator – uses a pulse process that converts electricity and water vapor into thrust. The system serves as a “safe, energy-efficient and inexpensive propellant,” Faler explains.

Current Hall-effects thrusters use solar panels to power them. But as satellites venture into deep space where power drops off exponentially, they move further away from the Earth and their power source – the Sun. Faler says the same thrust his system needs 10 or 20 watts to do, a Hall-effect thruster requires 1,000 watts. This “multi-phenomenon thrust” operates in a pulse cycle that makes it extremely efficient.

Miles Space is working with customer RocketStar, which wants to leverage the thruster as it designs a single-stage-to-orbit aerospike rocket that can fly again two weeks after launch.

Nuclear also shows promise for missions in deep space. Cassidy says Apollo Fusion, now Astra, has experimented with nuclear fusion, which is very dense and can provide a lot of capability for a small amount of weight.

The challenges, however, include meeting regulatory and safety standards for launching and flying radioactive material.

“Nuclear is where you can have the advantage of chemical and electric in one, but the barrier to entry is very high,” says Beck. “There’s no operational systems yet, but nuclear is the next step,” he concludes.

Exploring Hybrid Systems

Missions to LEO need cost-effective transportation, which is why rideshares are common. But this approach requires secondary propulsion on the satellite to get it into their value-added orbit.

Hybrid systems that feature the best of chemical and electrical propulsion are one concept the government is exploring. Yet some propulsion experts see a downside to that approach because of the added complexity of such systems.

“A key tenant of spacecraft design for LEO constellations is to keep things simple and lower cost. Adding that complexity is usually in the wrong direction,” argues Askijian.

“Hybrid systems are the holy grail – certainly the DoD [Department of Defense] and national security space would like something that is multimode where you can get higher thrust,” notes Hoskins of Aerojet Rocketdyne. “The jury's out on whether a multimode type of thruster is best for everything. A lot of conventional spacecraft have very specialized propulsion,” he adds.

Aerojet Rocketdyne is most known for large-thrust engines such as the RS-25 engines that will power NASA’s Space Launch System rocket, but the company’s in-space propulsion systems have helped power missions to “every planet in our solar system, the International Space Station and interstellar space,” according to Hoskins. These days the company also is investing heavily in smallsat propulsion technology. He indicates that the birth of large-scale LEO constellations led Aerojet Rocketdyne to see a market for smaller spacecraft propulsion.

“People know us for our big engines, but we have a whole group outside of Seattle that does in-space propulsion – engines up to about 600 pounds of thrust down to a fraction of a pound of thrust,” he says. The company has delivered over 21,000 in-space propulsion systems to date.

To Askijian, electric propulsion remains the way forward, especially in LEO. “It's a critical technology for constellation development from a space debris perspective, from an enabling a mission perspective. It's one of the most important areas of technological development that needs to occur to continue with the constellation growth and development of the space industry.”

But experts agree getting propulsion systems built, tested and deployed is not cheap and given the demands for multiple LEO spacecraft to support constellation buildouts, industry players are looking for ways to innovate faster.

Cassidy says Astra's engineering team is looking to replace expensive, custom tanks with commercial-off-the-shelf (COTS) material for Astra’s four-part thruster system. He envisions a future where space customers will be able to select the exact size tank needed to support a specific impulse, similar to building a propulsion system using Legos.

“We’re probably 30 to 40 percent of the way there from where we were 10 years ago. In another three or four years we'll probably be 70 to 80 percent of the way there. I think components that are plug and play are the future,” he says. VS